Invest on Data

Trade smart & confident

You will get access to:

-

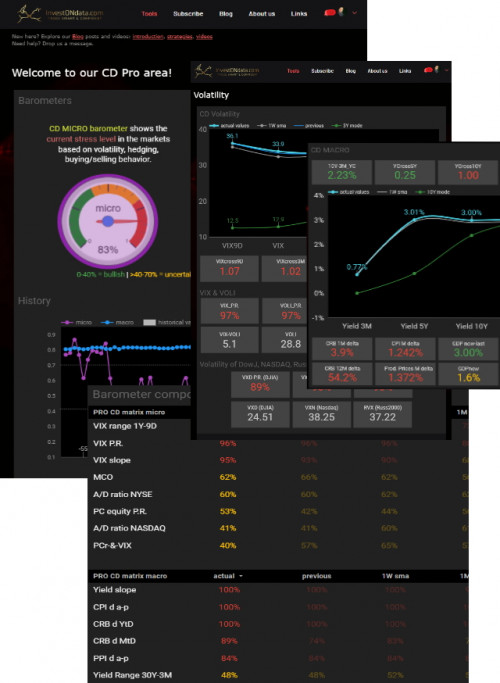

CD Micro and Macro Barometers

-

Micro and Macro Data Dashboards

-

Full data tables incl. raw and processed data

-

E-Mail support

Who will profit from CD Pro?

All types of market participants will benefit from our service. Here are a few examples:

-

Stock, ETF saving plans – adopt your recurring investments to market dynamics and avoid significant drawdowns.

-

Day trader – measure uncertainty for directional positioning.

-

Swing trader – identify exaggerations.

-

Options trader – optimize strategies.

“Invest on Data”

Our service is designed to assist you in this situation by providing:

-

direction based on selected indices/measures and their aggregated data,

-

indication of whether the dynamics suggest a bullish, neutral or bearish environment based on historical data and correlations.

-

Furthermore, we calculate and visualize ratios, crossovers, and percentile values for an instant understanding of dependencies, their significance, and meaningfulness.

This won’t replace your research to become a successful investor.

However, it will provide you with a convenient and instant -yet data-driven- approach to gauge the situation and direction of markets.

“Invest on Data”

How to profit from CD Pro?

Starting trading and investing in stock markets you will likely find yourself overloaded with information, its relevance, and meaning.

You end up in a real challenge:

-

how to prioritize – what is important to watch?

-

how to derive conclusions – is that bullish, neutral or bearish?

-

how to understand dependencies and interference – contradicting messages?

-

how to avoid emotions – will markets crash?

“Invest on Data”

Overview CD Pro Dashboards

Dashboard 1: Market overview

Barometers for instant reading of the situation at both #micro and #macro levels of the #U.S. #economy.

A history line chart shows the progress of barometer values over time providing an idea in which direction the #markets may move and implications for your trading or investing strategy.

The “components” sections deliver single values of all variables for detailed research and understanding. You will find the current, previous, and two average values showing 1-week and 1-month standard moving averages.

Dashboard 2: Volatility

Here you will find the major indices and parameters describing volatility. The famous Chicago Board Options Exchange’s CBOE Volatility Index (VIX) focusing on #S&P500 options and its futures is one major component. Beyond that, you will find other helpful products such as VOLI and other products measuring the volatility of the Dow Jones Industrial Average (DJI – VXD), #NASDAQ100 (VXN), and #Russel2000 (RVX).

Dashboard 3: Micro

This board provides selected indicators showing the behavior of insiders, advance-decline ratios at NASDAQ and NYSE, as well as positioning on the options market.

Dashboard 4: Macro

That board is relevant if you want to deeper understand the indication on the CD macro barometer. It visualizes the situation on the US treasury bond yield market and delivers #economy #health indicators such as GDP, CPI, etc. which directly impact the stock markets.

“Invest on Data”

100% SSL-Encrypted

100% SSL-Encrypted

Reviews

There are no reviews yet.